How Beginners Can Invest in Art Like Seasoned Experts

Credit: Image by inboundREM

Note: This image may include elements generated by artificial intelligence (AI).

Investing in art as a beginner can be daunting, but also the most exciting way to invest. At least that’s our totally biased but proud opinion. Just as Oprah said, “You can’t live in a mutual fund.”

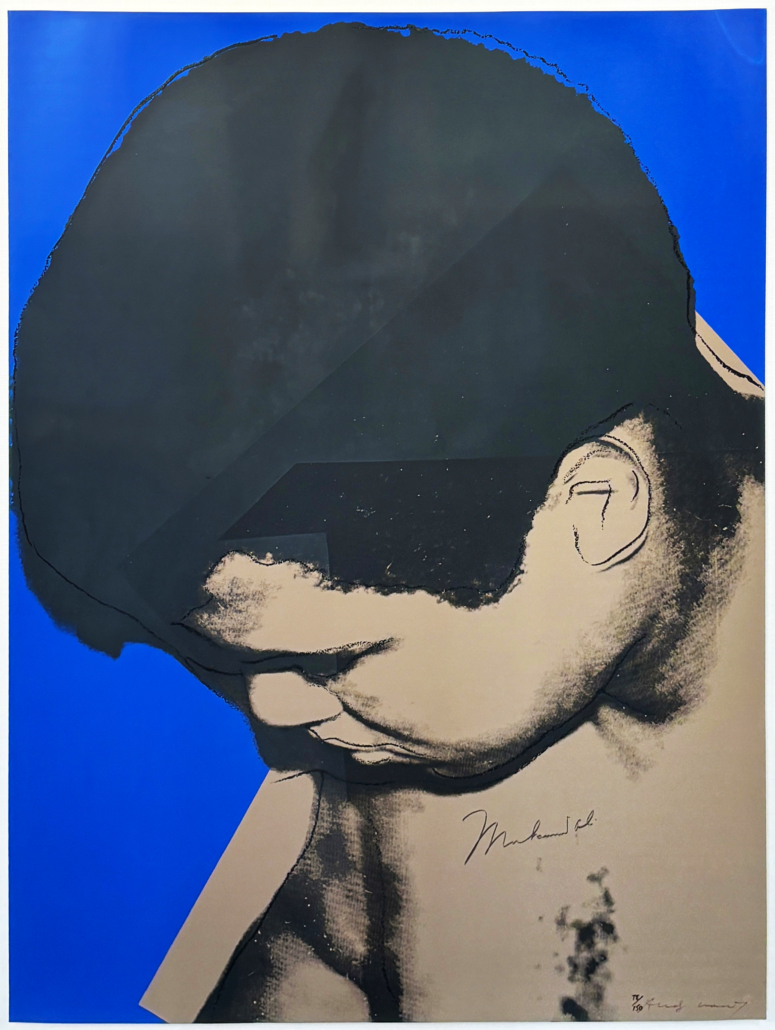

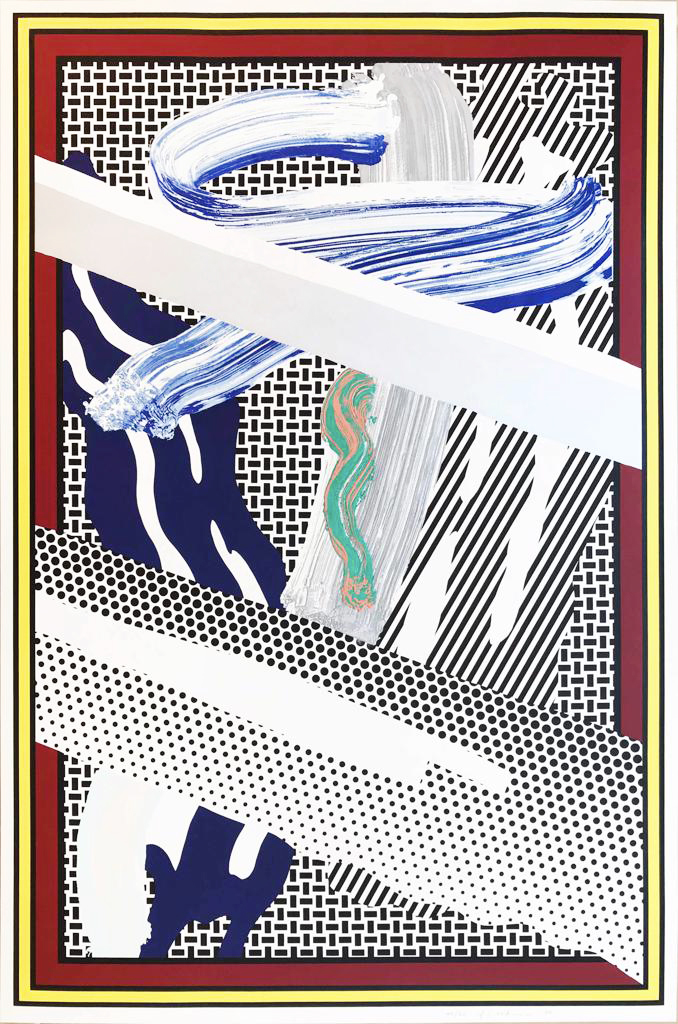

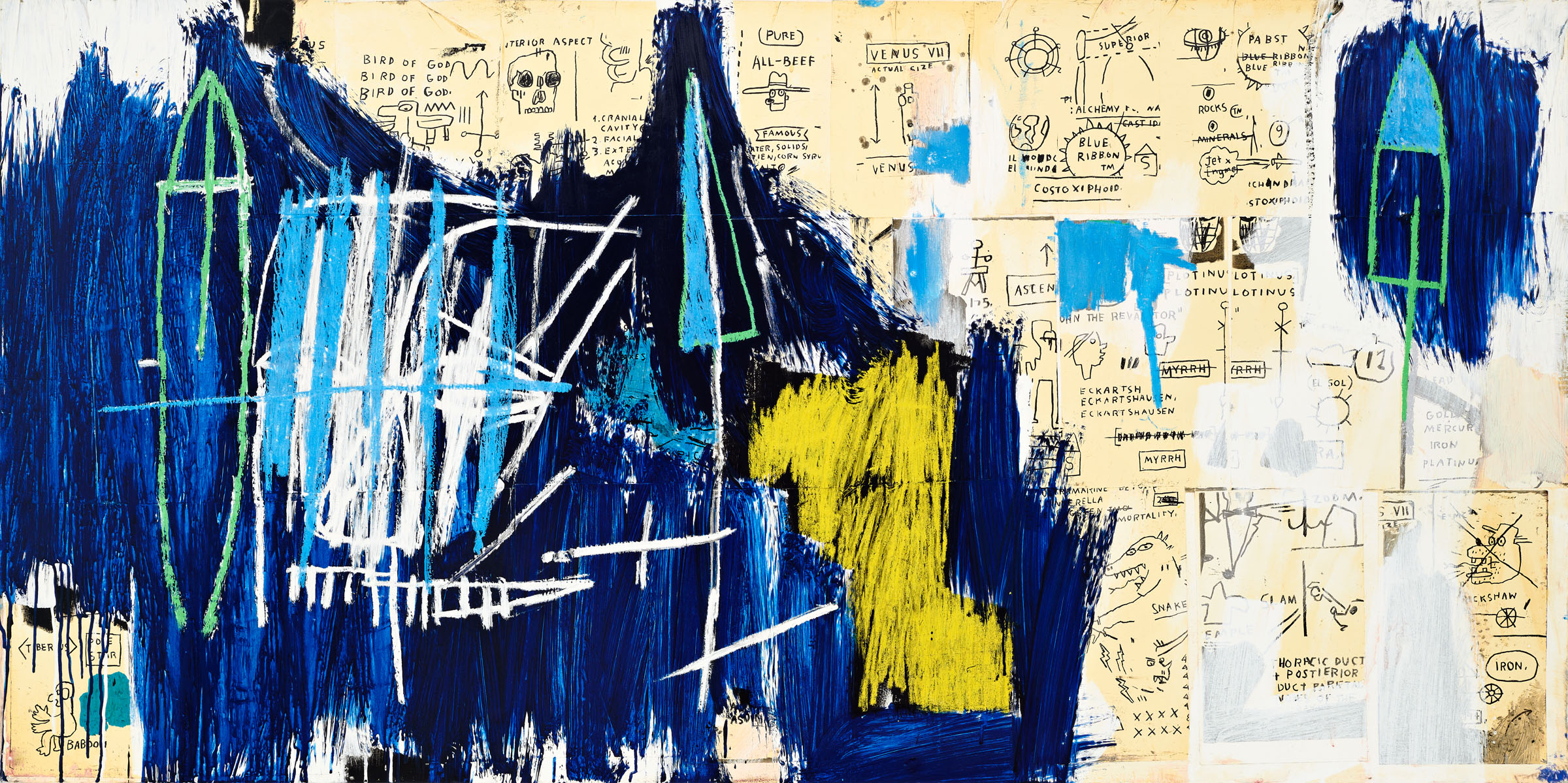

Well you can’t live in a signed Basquiat screenprint or a limited edition Warhol. But you can enjoy them every day, turning your house into a home. Those are just a couple of amazing entry-level options great for art investing beginners that can impress your friends and enrich your life.

Read on to find out how you can research and buy amazing art while ensuring you don’t make expensive missteps.

Why Invest in Art?

Art investment is more than just a financial move. It’s a personal and cultural journey. For centuries, art has symbolized wealth, sophistication, and creativity.

Today, the global art market has evolved into a $67.8 billion industry, presenting opportunities for investors at every level (Art Basel and UBS Global Art Market Report, 2023).

Top 3 Reasons to Invest in Art

- Diversification: Art provides a tangible asset that complements stocks, real estate, or crypto in your portfolio.

- Aesthetic Value: Beyond financial returns, owning art adds beauty and meaning to your space.

- Resilience: Historically, blue-chip art has appreciated at an annual rate of 7.6%, even during economic downturns (Sotheby’s Insights).

That said, if you’re not investing in blue chip art (think, paintings worth hundreds of thousands from famous artists), it’s really important you buy art you genuinely enjoy. That way you can’t lose.

But if you follow our tips, you’ll have a great start in ensuring those first pieces you buy will also appreciate in value.

Common Myths About Art Investment

Myth #1: “Art investment is only for the ultra-wealthy.”

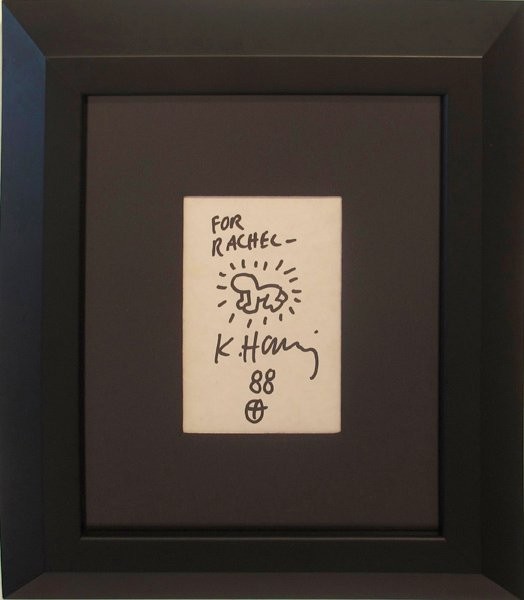

Fact: You don’t need millions to start. Limited-edition prints, like those sold by Hamilton Selway, offer an affordable entry point. For example, a numbered KAWS print costs far less than an original yet still holds scarcity and value.

Myth #2: “Art doesn’t generate returns like stocks.”

Fact: While art doesn’t pay dividends, it can yield strong appreciation over time. Deloitte’s 2022 Art & Finance Report reveals that 85% of wealth managers recommend art as a long-term investment (Deloitte Insights).

Myth #3: “Art is too hard to understand.”

Fact: Beginners have an advantage! Exploring emerging artists, local galleries, and online platforms can help you discover hidden gems.

How Beginners Can Start Investing in Art

- Start Small: Numbered prints, like those offered by Hamilton Selway, are a great first step. These works are affordable, often created by renowned artists, and carry scarcity due to their limited production.

- Do Your Research: Look into the artist’s reputation, exhibition history, and auction records.

- Visit Galleries: Building relationships with galleries is crucial. As a trusted gallery, Hamilton Selway can connect you with exclusive pieces and guide your investment journey.

- Define Your Goals: Are you buying for personal enjoyment, financial returns, or both? Clear goals will shape your decisions.

Key Takeaway

“Investing in art isn’t reserved for the wealthy—it’s for anyone ready to dive into a world of creativity and culture.”

Whether you’re drawn to bold pop art or serene landscapes, there’s an entry point for everyone. Starting small with a numbered print can help you learn the ropes while adding beauty to your life.

Art Investment Basics

Before diving into art investment, it’s essential to understand the fundamentals of the market. The art world may appear daunting at first, but with a clear grasp of its structure and key concepts, you’ll find that opportunities exist for every budget and level of expertise.

Types of Art You Can Invest In

There are several types of art to consider as a beginner:

- Original Artworks:

These are one-of-a-kind pieces, like paintings or sculptures, created directly by the artist. Original works often come with the highest price tags and offer the most significant appreciation potential. For instance, Jean-Michel Basquiat’s painting Untitled sold for $110.5 million at Sotheby’s in 2017 (Sotheby’s). While these works are typically for high-budget collectors, they serve as a benchmark for how valuable art can become. - Numbered Prints:

Limited-edition prints are a more affordable way to own works by well-known artists. These are produced in small quantities, often signed and numbered by the artist. In the case of the artist’s death, they are signed by the estate managing the artist’s legacy. - Emerging Art:

Investing in works by up-and-coming artists can yield significant returns if the artist’s reputation grows. The risk is higher in this category, but the initial cost is often much lower, making it an exciting option for adventurous investors. - Digital Art and NFTs:

Technology has introduced a new frontier in art investment. NFTs (non-fungible tokens) and digital artworks have exploded in popularity, with Beeple’s Everydays: The First 5000 Days NFT selling for $69 million at Christie’s (Christie’s). While promising, this market requires careful research due to its volatility and rapid evolution.

The Primary vs. Secondary Market

Another key distinction in the art world lies between the primary and secondary markets.

- Primary Market: This is where art is sold for the first time, often directly from the artist or through galleries. Pieces here tend to be more affordable since they have no resale history. If you’re interested in investing in contemporary art, Hamilton Selway can help you access exclusive works early in their market life.

- Secondary Market: Art resold by collectors, auction houses, or dealers belongs to the secondary market. These pieces often come with a track record of pricing history, helping you assess their value.

Collecting vs. Investing

It’s important to clarify whether you’re collecting art for personal enjoyment or investing for financial gain.

Collectors focus on pieces that resonate with their tastes, while investors prioritize works with strong market potential.

However, these goals can overlap. For example, buying a famous screenprint can satisfy your love for pop art while offering the potential for long-term appreciation.

Key Terms Every Beginner Should Know

Here are some essential terms to familiarize yourself with as you navigate the art world:

- Provenance: The ownership history of a piece. A documented provenance increases both authenticity and value.

- Edition Size: For prints, smaller editions are more exclusive and often more valuable.

- Rarity: Scarcity adds to an artwork’s appeal. The fewer copies or variations, the greater its investment potential.

- Blue-Chip Art: Works by established artists like Picasso or Hockney, known for stable and consistent value appreciation.

Key Takeaway

“Art investment starts with understanding the basics: types of art, market channels, and key terms that define value.”

Numbered prints, especially from trusted galleries like Hamilton Selway, offer an accessible way for beginners to step into the art world while combining affordability with prestige.

How to Research and Evaluate Art for Investment

Investing in art requires careful research and a strategic approach. While the art market may feel opaque to beginners, understanding how to evaluate artists and artworks ensures your investment is both meaningful and financially sound. Let’s break it down.

Start by Evaluating the Artist

The artist’s career trajectory is often the strongest indicator of an artwork’s value. Look for the following factors when assessing an artist:

- Institutional Recognition: Artists with exhibitions at prestigious institutions like MoMA or the Tate Modern often see their market value rise over time.

- Awards and Residencies: Acclaimed prizes or artist-in-residence programs are strong signals of an artist’s talent and credibility. For instance, recipients of the Turner Prize or Whitney Biennial participants often gain international recognition.

- Press and Publications: Coverage in reputable art publications, such as Artforum or Frieze Magazine, can indicate the artist is gaining momentum within the art world.

Assessing the Artwork Itself

An artwork’s value depends on a combination of tangible and intangible factors:

- Provenance: A documented history of ownership not only boosts the value but also ensures authenticity. Galleries like Hamilton Selway provide verified provenance for all their works, adding peace of mind for buyers.

- Rarity: Limited-edition prints or one-of-a-kind pieces naturally hold more value due to their exclusivity. For example, a Warhol print with an edition size of 50 is far scarcer—and more desirable—than a mass-produced reproduction.

- Condition: Look for any physical damage, discoloration, or signs of poor restoration. These factors can significantly impact value, especially for older works.

Pro Tip: If you’re buying from an emerging artist, it’s best to purchase works that “headline” an exhibition. Though brand-new, these works have been pre-selected for greatness. You should collect as much provenance as possible, including brochures, photos of the original exhibition, and even screenshots of any news appearances online.

Recommended Research Tools

While some platforms overlap with art sales, there are other reliable tools and resources for researching the art market:

- Museum Collections: Many museums, such as the Metropolitan Museum of Art or the Getty, provide online archives where you can explore artists’ works and their histories.

- Public Auction Data: Sites like Sotheby’s and Christie’s often publish auction results and analysis, which are valuable for understanding pricing trends.

- Books and Academic Papers: Books like The Value of Art: Money, Power, Beauty by Michael Findlay are excellent resources for learning about art valuation. Scholarly articles and art history journals can also provide insight into an artist’s significance.

- Google Scholar: This free tool helps you find academic and critical research on specific artists, movements, and market trends.

According to Deloitte’s 2022 Art & Finance Report, 74% of collectors now use online tools for market analysis, showcasing the importance of leveraging these resources to make informed purchases.

How to Avoid Forgeries

Art forgeries and fraud are an unfortunate reality, with the FBI estimating $6 billion lost annually to art crimes. Follow these tips to protect yourself:

- Always request a certificate of authenticity (COA).

- Research the gallery or seller’s reputation. Established galleries like Hamilton Selway provide the assurance of selling authenticated, high-quality works.

- Verify provenance documents to confirm the artwork’s history.

- Cross-check with registries like The Art Loss Register to ensure the piece hasn’t been stolen or misrepresented.

Key Takeaway

“Successful art investment is built on research. Focus on the artist’s background, evaluate the artwork’s rarity and condition, and use reliable tools to guide your decisions.”

By starting with reputable galleries and leveraging trusted resources, you can make informed investments with confidence.

How to Budget and Plan for Your First Art Investment

Jumping into the art market without a plan is like navigating uncharted waters without a map. Budgeting and setting clear goals are vital for beginners, ensuring your first art investment aligns with your financial situation and long-term aspirations. Here’s how to start on solid footing.

1. Set Your Budget

Contrary to popular belief, art investment isn’t reserved for the ultra-wealthy. While record-breaking sales dominate headlines, there are accessible entry points for all budgets. For example, limited-edition prints by renowned artists can start at a few thousand dollars. At Hamilton Selway, prints from legends like Andy Warhol or Damien Hirst are priced to make fine art ownership more attainable.

To determine your budget, consider the following factors:

- Initial Purchase: Decide how much you’re willing to spend upfront. Deloitte’s Art & Finance Report suggests that new collectors typically allocate 1-5% of their overall investment portfolio to art.

- Additional Costs: Factor in expenses like framing, insurance, storage, and shipping. For example, high-quality framing can cost $500 or more depending on the artwork’s size and complexity.

2. Set Your Investment Goals

Art can serve multiple purposes: personal enjoyment, financial growth, or a mix of both. Defining your goals helps you stay focused and avoid impulsive purchases.

- For Aesthetic Value: If your main goal is to enhance your living space, prioritize pieces that resonate with your style. A Warhol print can double as a conversation starter and a smart investment.

- For Financial Returns: If ROI is your focus, prioritize artworks with a track record of appreciation. Look for blue-chip artists or emerging talents with institutional backing.

- Long-Term vs. Short-Term: Art is generally a long-term investment. According to ArtTactic’s 2023 report, works by established artists appreciate steadily over 5-10 years, while emerging artists may show quicker but riskier growth.

3. Consider Affordable Entry Points

As a beginner, your first purchase doesn’t need to break the bank. Here are some accessible ways to start:

- Limited-Edition Prints: These offer a blend of affordability and prestige. Numbered and signed prints maintain scarcity and are highly sought after.

- Emerging Artists: Works by lesser-known artists can cost anywhere from $500 to $10,000, offering a chance to spot the next big name.

- Local Galleries: Trusted galleries, such as Hamilton Selway, often provide curated options for first-time buyers.

4. Plan for the Long Term

Art is a patient person’s investment. Unlike stocks or real estate, art’s value often appreciates over years, not months. A 2018 study by Art Basel showed that blue-chip artworks appreciated at an average rate of 8.2% annually over two decades. To maximize returns:

- Avoid “trend-chasing.” Focus on works with lasting cultural or artistic value.

- Build a collection gradually. Start small and expand your portfolio as you gain confidence.

- Cultivate relationships with galleries. Trusted galleries can provide exclusive access to sought-after pieces before they hit the open market.

Key Takeaway

“Budgeting and planning are essential steps in art investment. By setting realistic goals and starting with accessible pieces, you’ll create a strong foundation for building a collection.” Numbered prints and emerging art from galleries like ours offer a perfect balance of affordability, quality, and potential growth.

The Advantages of Building Relationships with Art Galleries

One of the most valuable strategies for new art investors is developing relationships with galleries.

While online platforms and auction houses provide access to a wide array of art, galleries offer a unique advantage: personal connections, expert guidance, and access to exclusive works. These relationships can be the key to uncovering opportunities that others may never see.

Why Galleries Matter

Galleries play a central role in the art ecosystem. They don’t just sell art—they support artists, curate exhibitions, and nurture careers.

Pro Tip: By engaging directly with galleries, you gain access to their expertise and insight. This is particularly valuable for beginners, who may feel overwhelmed by the art market’s complexity.

According to the 2022 Art Basel and UBS Global Art Market Report, galleries accounted for 43% of global art sales, making them a cornerstone of the market.

Their focus on cultivating long-term relationships means they often prioritize guiding clients toward pieces that align with their tastes and goals rather than just pushing sales.

Benefits of Building Relationships with Galleries

- Access to Exclusive Pieces

Many of the most sought-after works never make it to public auctions. Galleries often sell these privately to trusted clients. By establishing a relationship, you can gain early access to these opportunities before they hit the open market. - Expert Advice

Galleries offer personalized advice based on your interests and investment goals. Whether you’re considering a piece by an emerging artist or a work from a major name, gallery representatives can provide invaluable context, such as the artist’s career trajectory, market trends, and comparable sales. - Provenance and Authenticity

Galleries handle the legwork of verifying an artwork’s provenance, ensuring authenticity. This is particularly important in a market where forgeries are a persistent issue. - Opportunities to Commission Artwork

As you build a rapport with galleries, they may offer opportunities to commission works directly from artists. This allows you to acquire a truly unique piece while supporting the artist’s creative process.

How to Start Building Relationships

- Visit Local Galleries: Attend openings, exhibitions, and artist talks. This not only familiarizes you with the gallery’s offerings but also demonstrates your genuine interest in the art world.

- Ask Questions: Don’t be afraid to seek guidance. Gallery representatives are there to help, and asking thoughtful questions shows your commitment to learning.

- Be Consistent: Regular visits or purchases, even small ones, signal to galleries that you’re serious about collecting. Over time, this consistency can lead to exclusive opportunities.

- Participate in Events: Many galleries host private previews or collector dinners. These events are excellent for networking with other collectors and gaining insight into the art market.

Key Takeaway

“Building relationships with galleries is about more than buying art—it’s about gaining access to expertise, trust, and opportunities that elevate your collection.”

Whether you’re acquiring your first piece or expanding your portfolio, galleries provide the foundation for a meaningful and successful investment journey.

Note: This image may include elements generated by artificial intelligence (AI).

Understanding the Financial Side of Art Investment

Investing in art isn’t just about aesthetics—it’s also a financial decision. While art offers the dual appeal of cultural and monetary value, it’s important to understand the costs and potential returns involved. A well-informed approach to the financial aspects of art investment can help you make smarter choices and avoid common pitfalls.

How Much Money Do You Need to Start?

The beauty of art investment is its flexibility. While headlines focus on multimillion-dollar auctions, the reality is that beginners can start with much smaller budgets. Limited-edition prints and works by emerging artists often range from $1,000 to $10,000, making them accessible to a wide audience. According to the Hiscox Online Art Trade Report, 60% of art buyers in 2023 spent less than $10,000 per purchase, highlighting the affordability of entry-level investments.

To determine your budget:

- Evaluate your disposable income and consider allocating 1-5% of your overall investment portfolio to art.

- Remember that art is a long-term investment. Avoid spending more than you can afford to tie up for several years.

The Hidden Costs of Art Investment

Beyond the purchase price, investing in art comes with additional expenses that must be factored into your budget. These include:

- Framing and Display: Professional framing can cost $300-$1,000 depending on the size and materials. UV-protective glass is often recommended to prevent fading.

- Insurance: Art insurance typically costs 1-2% of the artwork’s value annually. For example, insuring a $5,000 piece could cost $50-$100 per year.

- Storage and Maintenance: If not displayed, artworks must be stored in climate-controlled environments to prevent damage. This can cost $50-$200 monthly for specialized storage facilities.

- Transaction Fees: Auction houses and some online platforms charge commissions ranging from 10-25% of the sale price.

Understanding Art Valuation

Art doesn’t generate dividends or interest, so its value is determined by market demand. Several factors influence an artwork’s valuation:

- Artist Reputation: Established artists with a strong market presence, such as Yayoi Kusama or David Hockney, typically command higher prices.

- Historical Significance: Artworks tied to significant movements or moments in history often carry premium value.

- Market Trends: According to ArtTactic, blue-chip art from the top 25 artists has consistently outperformed other segments, appreciating by 12.9% annually from 2000 to 2020.

Tax Implications of Buying and Selling Art

Art investment comes with tax considerations that vary by region:

- Sales Tax: Depending on where you purchase art, you may need to pay sales tax. In the U.S., this can range from 5-10%.

- Capital Gains Tax: When selling art, profits are typically subject to capital gains tax. In the U.S., art is considered a collectible, with a maximum tax rate of 28%.

- Deductions: If you donate artwork to a museum or charitable institution, you may qualify for a tax deduction based on its fair market value.

Consulting with a tax professional or art advisor is essential to ensure compliance and maximize financial benefits.

How Art Compares to Other Investments

Art is often viewed as an alternative asset class, offering benefits that differ from traditional investments like stocks or real estate:

- Non-Correlation: Art prices tend to be independent of stock market fluctuations, making it a good hedge during economic downturns. For example, art sales remained robust during the 2008 financial crisis, with a 12% annual growth in blue-chip art values (Art Basel Report).

- Tangible Value: Unlike stocks, art has physical presence and aesthetic appeal. It’s an asset you can enjoy while it appreciates.

Lower Liquidity: Selling art often takes time, especially compared to stocks or real estate. Be prepared to hold onto your pieces for several years to maximize returns.

Key Takeaway

“Art investment requires careful financial planning, from setting a realistic budget to understanding hidden costs and tax implications.” By focusing on long-term value and preparing for associated expenses, you can build a collection that’s both beautiful and financially rewarding.

Where and How to Buy Art as a Beginner

Finding the right place to buy art is just as important as selecting the art itself. While there are numerous avenues for purchasing artworks, knowing the pros and cons of each can help you make informed decisions. For beginners, it’s essential to choose trustworthy sources that provide guidance, transparency, and opportunities to learn.

1. Art Galleries: The Trusted Option

Galleries remain one of the most reliable and beginner-friendly sources for purchasing art. Their expertise, curation, and access to exclusive works make them invaluable for new collectors.

- Why Galleries Are Ideal:

Galleries offer a curated selection of works, often accompanied by detailed information about the artist and the piece. The relationship-building aspect is another significant advantage; galleries often give loyal clients first access to new works or private sales.

How to Approach Galleries:

Visit exhibitions, introduce yourself to the gallery staff, and express your interests. Asking questions shows you’re serious about learning, and many galleries are happy to educate new collectors.

2. Online Art Platforms and Auctions

The digital age has revolutionized art buying, making it easier than ever to explore a wide range of artworks from the comfort of your home. While platforms like Artsy or Sotheby’s have a strong online presence, they can be overwhelming for beginners due to their vast inventory and bidding processes.

For newcomers:

- Look for platforms that offer educational resources or customer support to guide your purchase.

- Avoid impulse purchases. Take your time to research the artist, the piece’s provenance, and its price.

3. Art Fairs and Expos

Art fairs are fantastic for discovering a wide variety of styles and meeting galleries and artists directly. Events like Art Basel Miami Beach, The Armory Show, or Frieze London feature works across all price ranges, from emerging talent to established names.

- What to Expect:

Art fairs can be fast-paced, with limited time to make decisions. Before attending, research the participating galleries and artists so you can focus on booths that align with your interests. - Pro Tip: Don’t hesitate to ask for price ranges or payment options—many galleries at fairs offer flexible payment plans to encourage new buyers.

4. Studio Visits and Direct Artist Sales

Buying directly from an artist can be an intimate and rewarding experience. Studio visits allow you to see an artist’s creative process, ask questions about their work, and often purchase pieces at lower prices since there’s no gallery commission.

- How to Arrange a Studio Visit:

Reach out through social media or the artist’s website. Many emerging artists are happy to accommodate collectors who are genuinely interested in their work.

5. Auction Houses

While auctions are typically seen as a venue for seasoned collectors, they can also be a valuable resource for beginners. Major auction houses like Christie’s or Phillips hold sales featuring prints and smaller works that are more accessible to first-time buyers.

- Tips for Auction Success:

- Research the piece beforehand, including its estimate and recent sales of similar works.

- Set a strict bidding limit to avoid overpaying in the heat of the moment.

- Factor in buyer’s premiums, which can add 10-25% to the hammer price.

6. Local Art Events and Emerging Artist Markets

Community art events, pop-up galleries, and local art markets are excellent places to start your collection. These venues often feature emerging talent at affordable prices, providing an opportunity to discover future stars before they gain widespread recognition.

Example: At a local art fair, you might find an emerging artist offering original works for under $1,000—pieces that could appreciate significantly as their career develops.

Storing and Insuring Your Art

Once you’ve made your first art investment, the next step is to ensure your piece is properly cared for. Unlike stocks or bonds, art requires physical maintenance to preserve its value. From storage solutions to insurance policies, these considerations protect your investment for years to come.

Proper Storage: Protecting Your Investment

Whether you plan to display your artwork immediately or store it for future use, taking the right precautions is essential. Improper storage can lead to damage that diminishes the value of your piece.

- Temperature and Humidity:

Artworks, especially those on canvas or paper, are sensitive to environmental changes. According to the American Institute for Conservation, the ideal storage conditions are 70°F with 50% relative humidity. Avoid basements or attics, where fluctuations in temperature and moisture are common. - Lighting:

Direct sunlight can cause fading and discoloration, particularly in works on paper or textiles. If displaying art, use UV-filtered glass or acrylic in your framing. LED lights are a safe choice for illuminating artwork, as they emit minimal UV radiation and heat. - Framing:

Professional framing provides both aesthetic enhancement and physical protection. Archival-quality materials, such as acid-free matting and UV-protective glass, prevent deterioration. - Storage Solutions:

If not displaying your art, store it in a climate-controlled environment. For larger collections or higher-value works, consider specialized art storage facilities, which typically charge $50-$200 per month based on the size and value of your collection.

Insuring Your Art

Art insurance is a must-have for any collector. While it represents an additional expense, it provides peace of mind in the event of theft, damage, or natural disasters.

- How to Insure Your Art:

- Obtain an appraisal from a certified art appraiser. This ensures the value of your artwork is accurately documented.

- Research specialized art insurance providers, such as AXA XL or Huntington T. Block. General home insurance policies often don’t provide sufficient coverage for fine art.

- Update your policy as your collection grows or if the value of a piece appreciates significantly.

Cost of Art Insurance:

Art insurance premiums typically range from 1-2% of the insured value annually. For instance, insuring a $10,000 piece might cost $100-$200 per year.

When and How to Sell Your Art Investment

Art investment is often a long-term commitment, but there may come a time when you’re ready to sell a piece. Whether it’s to realize a profit, diversify your collection, or free up funds for a new acquisition, knowing when and how to sell your art is just as critical as buying it. A strategic approach ensures you maximize returns while maintaining the integrity of your collection.

When Is the Right Time to Sell?

Timing is everything when it comes to selling art. Unlike stocks or other liquid assets, art requires patience and market awareness to secure the best price. Here are key indicators that it may be time to sell:

- Significant Market Appreciation: If the value of a piece has risen substantially since you purchased it, selling can be a smart financial move. For example, a piece by a rising artist might double in value after a high-profile exhibition.

- Changing Tastes or Goals: Over time, your personal preferences or investment objectives may shift. Selling older pieces can help fund new acquisitions that better align with your current interests.

- Market Trends: Art values often rise when an artist gains renewed attention, such as a retrospective exhibition or a prominent auction result.

- Financial Needs: If you need liquidity for other investments or expenses, selling an appreciated piece can be a practical solution.

Where to Sell Your Art

The art market offers several avenues for selling, each with its own advantages and challenges. Choosing the right one depends on your goals, timeline, and the value of the piece.

- Auction Houses:

Major auction houses like Sotheby’s, Christie’s, and Phillips are ideal for high-value works. Auctions create competitive bidding environments that can drive prices higher, especially for blue-chip art. However, these houses charge significant fees, typically 10-25% of the final sale price.

Example: In 2022, Sotheby’s sold a Mark Rothko painting for $82.5 million, showcasing the potential of auctions for top-tier works. - Private Sales:

Private transactions, often facilitated by galleries or dealers, offer discretion and flexibility. These sales allow you to negotiate terms directly with buyers, avoiding public scrutiny and auction fees. - Online Platforms:

Websites like Artsy and MutualArt cater to a global audience, making them a viable option for mid-range pieces. Ensure you choose a platform that offers secure transactions and visibility to serious buyers. - Galleries:

If your artwork was originally purchased through a gallery, they might help resell it. Galleries often have strong connections with collectors interested in works by specific artists.

How to Prepare Your Artwork for Sale

Before listing your artwork, take steps to ensure you present it in the best possible light:

- Update Provenance and Documentation: Gather all relevant paperwork, including certificates of authenticity, purchase receipts, and any exhibition history.

- Appraise the Artwork: Hire a certified appraiser to determine the current market value. The International Society of Appraisers (ISA) and Appraisers Association of America (AAA) are excellent resources.

- Condition Report: Ensure the piece is in excellent condition. If necessary, invest in minor restoration or conservation to maximize its value.

- Professional Photography: High-quality images can make a significant difference in attracting buyers, especially for online sales.

Negotiating and Closing the Sale

When selling art, negotiations are often part of the process. To secure the best deal:

- Set a Reserve Price: This is the minimum amount you’re willing to accept for the piece.

- Be Patient: High-value sales can take time, especially in private markets where buyers may need to consider significant financial decisions.

Consult Experts: If you’re unsure about pricing or strategy, consider hiring an art advisor to guide the process.

Tax Considerations When Selling Art

Selling art can trigger significant tax obligations, particularly capital gains tax. In the U.S., art is classified as a collectible, subject to a 28% maximum federal tax rate on gains. To mitigate this:

- Track Your Costs: Keep records of your original purchase price, restoration costs, insurance, and other expenses to calculate the accurate cost basis.

Consider a 1031 Exchange: In some cases, you can defer taxes by reinvesting the proceeds into another artwork of equal or greater value. Consult with a tax advisor to determine eligibility.

Art Investment Trends and Innovations

The art world is constantly evolving, with new trends and innovations reshaping the market. From digital art to fractional ownership, these developments are opening doors for both seasoned collectors and beginners. Staying informed about these trends can help you make smarter decisions and identify emerging opportunities in art investment.

1. The Rise of Digital Art and NFTs

Digital art has revolutionized the traditional art market, with NFTs (non-fungible tokens) leading the charge. NFTs use blockchain technology to verify ownership and authenticity, allowing collectors to invest in digital creations.

- Key Milestone: Beeple’s NFT artwork, Everydays: The First 5000 Days, sold for $69.3 million at Christie’s in 2021, cementing NFTs as a legitimate investment (Christie’s).

- Why It Matters: NFTs provide transparency and traceability, two factors that have historically been challenges in the art market. They also open up new revenue streams for artists and collectors.

However, NFTs can be volatile. Prices often fluctuate based on market hype, so it’s crucial to research creators and trends thoroughly before investing. Look for established digital artists or collaborations with reputable institutions.

2. Fractional Art Ownership

Fractional ownership is an innovative way to invest in high-value artworks without needing millions of dollars. Through platforms that specialize in fractionalized assets, investors can purchase “shares” in iconic pieces of art, similar to owning stock in a company.

- How It Works: A single artwork is divided into shares, allowing multiple investors to own a fraction of it. The artwork’s appreciation is shared among investors based on their ownership percentage.

- Benefits:

- Accessibility: Fractional ownership allows investors to access works by renowned artists like Basquiat or Rothko.

- Liquidity: Many platforms offer secondary markets where investors can trade their shares.

- Example: Masterworks, one of the leading platforms in this space, allows investors to participate in fractional ownership of blue-chip art.

3. Art Funds and Crowdfunding

Art funds pool resources from multiple investors to purchase and manage collections. These funds are managed by experts who handle acquisitions, sales, and valuations, making them an appealing option for those seeking a hands-off approach to art investment.

Crowdfunding for art investments has also gained traction, particularly for emerging artists or large-scale projects. Platforms like Kickstarter and GoFundMe allow investors to support creative ventures while receiving perks like limited-edition prints or early access to new works.

4. Artificial Intelligence in Art Valuation

AI tools are increasingly being used to analyze and predict art market trends. By processing large datasets on artist performance, sales history, and market trends, AI can provide more accurate valuations and identify undervalued artists.

- Example: The platform Arthena uses AI to guide investors by analyzing data on more than 150,000 artists.

- Future Potential: AI could democratize access to high-quality market analysis, enabling beginners to compete with seasoned investors.

5. Sustainable and Ethical Investing

Sustainability is becoming a key focus in the art world. Many collectors are now prioritizing works created with eco-friendly materials or supporting artists and galleries with sustainable practices. Similarly, ethical investing involves backing underrepresented artists and supporting diversity in the art market.

- Why It Matters: Investing in sustainable and ethical art not only aligns with personal values but can also enhance the cultural significance—and, potentially, the value—of your collection.

- Examples: Initiatives like the Gallery Climate Coalition promote sustainable practices in the art world, encouraging collectors and institutions to reduce their carbon footprint.

How to Stay Ahead of Trends

To keep up with innovations in art investment:

- Follow Market Reports: Resources like the Art Basel and UBS Global Art Market Report provide in-depth insights into emerging trends.

- Attend Industry Events: Art fairs, symposiums, and panel discussions often showcase new technologies and market developments.

Subscribe to Art Publications: Reputable magazines like Artforum and The Art Newspaper regularly cover the latest innovations and trends.

Key Takeaway

“Staying informed about art investment trends and innovations is essential for making forward-thinking decisions. From NFTs to fractional ownership, these developments are transforming how collectors and investors engage with the art world.” By embracing these changes and using the tools available, you can expand your opportunities and diversify your art portfolio.

Resources for Art Investors

Having the right tools and resources at your disposal is essential for making informed decisions. These platforms and organizations can help you analyze the market, research artists, and manage your collection.

Research and Analysis Tools

- Museum Archives:

- Institutions like the Getty Research Institute and the Smithsonian Archives of American Art provide comprehensive artist records and exhibition histories.

- Auction Data:

- Use auction house websites like Sotheby’s and Christie’s to track pricing trends for specific artists.

- Books:

- The Value of Art: Money, Power, Beauty by Michael Findlay offers insights into how the art market works.

- Collecting Contemporary Art by Adam Lindemann provides practical tips for beginners.

Art Conservation and Care

- American Institute for Conservation (AIC): Offers resources on proper care and restoration techniques for artworks.

- Local Conservators: Certified professionals can assess the condition of your collection and provide maintenance recommendations.

Educational Resources

- Art Market Reports:

- The Art Basel and UBS Global Art Market Report offers in-depth insights into industry trends.

- Art Publications:

- Magazines like Artforum and The Art Newspaper cover market developments and critical reviews.

- Online Courses:

- Platforms like Coursera and MasterClass offer courses on art history and market trends, helping you deepen your understanding.

Collector Communities and Forums

Joining art-focused communities can provide networking opportunities and valuable insights from experienced collectors:

- Reddit: Subreddits like r/Art and r/ArtInvesting foster discussions about trends and artist discoveries.

Collector Groups: Many local art organizations host networking events and online forums for collectors to exchange ideas.

Conclusion: Your First Steps into Art Investment

Investing in art as a beginner is an exciting journey that blends creativity, culture, and financial potential. With the right knowledge, tools, and strategies, you can confidently navigate the art market and build a meaningful collection. Remember to start small—whether with numbered art prints or emerging artists—and focus on pieces that align with both your personal tastes and long-term investment goals.

By leveraging trusted resources, building relationships with galleries, and staying informed about market trends, you’ll position yourself for success in this unique asset class. Art isn’t just about returns; it’s about owning something tangible, beautiful, and culturally significant. As you take your first steps, remember that every masterpiece, even in the making, starts with a single brushstroke—or in this case, your first purchase.

“How to invest in art for beginners” is not just a question—it’s the beginning of a rewarding adventure. Whether you’re drawn to contemporary art, timeless blue-chip works, or innovative digital art, there’s a world of opportunity waiting for you. Now is the time to start building your collection and making your mark on the art world.